Car title loans Texas with no inspection provide quick cash for borrowers with less-than-perfect credit, as secured by their vehicle's title. Streamlined process eliminates inspections, offering same-day funding and flexible terms. Borrowers maintain control of their vehicles while making affordable payments, but missed payments may lead to repossession.

In Texas, car title loans with no inspection offer a convenient and swift financial solution. This article demystifies this process, explaining how borrowers can access cash using their vehicle’s title as collateral without undergoing traditional inspections. We’ll delve into the straightforward steps, advantages for borrowers, and crucial considerations to ensure informed decision-making in the vibrant Texas market.

- Understanding Car Title Loans in Texas

- The Process Without Vehicle Inspection

- Advantages and Considerations for Borrowers

Understanding Car Title Loans in Texas

In Texas, car title loans have emerged as a popular option for individuals seeking quick financial solutions. These loans are secured by a vehicle’s title, allowing lenders to offer fast cash with relatively fewer restrictions. Unlike traditional loans that require extensive paperwork and credit checks, car title loans in Texas with no inspection provide an alternative route to accessing emergency funds. This process is straightforward and often appeals to those with less-than-perfect credit or limited banking options.

The concept is simple: borrowers hand over their vehicle’s title as collateral, and if they can make timely payments, the title is returned upon loan repayment. This arrangement enables lenders to offer flexible terms and lower interest rates compared to other short-term financing options, such as Title Pawns or fast cash loans without a credit check. It’s a convenient solution for folks in need of quick funds, ensuring they can keep their vehicles while accessing much-needed financial assistance.

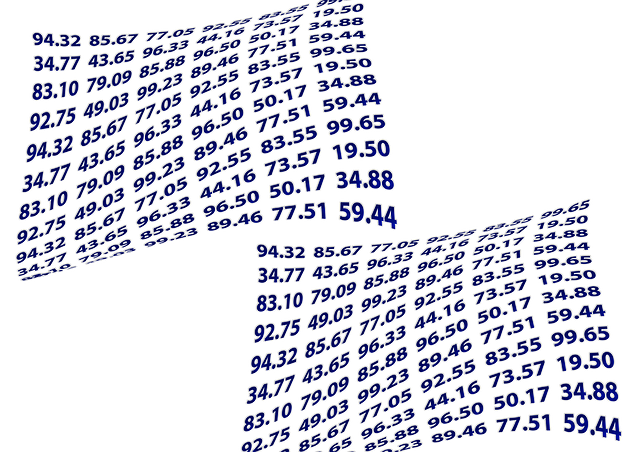

The Process Without Vehicle Inspection

In Texas, one of the unique aspects of car title loans is that they offer a streamlined process without requiring a vehicle inspection. When you apply for this type of loan, lenders primarily focus on your vehicle’s value and your ability to repay rather than conducting an extensive check-up. This means no need for you to spend time and money getting your car professionally inspected.

The absence of an inspection streamlines the entire process, enabling quick funding. Lenders can quickly assess your car’s title and determine its worth, often through digital documentation. For individuals with bad credit or limited financial history, this approach is particularly appealing as it overlooks traditional credit checks. The funds are then directly deposited into your account, providing a convenient and accessible solution for those in need of urgent funding.

Advantages and Considerations for Borrowers

Car title loans Texas with no inspection offer several advantages for borrowers. One of the key benefits is the streamlined title loan process. Without the need for a thorough vehicle inspection, applicants can secure funding more quickly. This means that borrowers can access the same day funding they need without delays or hassle. It also simplifies the overall experience, making it easier for individuals to manage their financial emergencies efficiently.

Additionally, this type of loan is ideal for those who are confident in their vehicle’s condition and ownership. Since lenders rely solely on the value of the car title, borrowers retaining vehicle ownership throughout the loan period is a significant consideration. This setup allows them to continue using their vehicle as usual while making manageable payments. However, it’s crucial to remember that missing payments can result in repossession of the vehicle, so responsible borrowing practices are essential.

Car title loans in Texas have evolved to offer a streamlined process, eliminating the need for a vehicle inspection. This is particularly beneficial for borrowers looking for quick access to cash without the usual hurdles. While this method provides flexibility, it’s essential to remember that lenders may still conduct verification checks and require clear vehicle ownership records. Understanding these simplified procedures can empower Texas residents to make informed decisions regarding their financial needs, ensuring a smoother borrowing experience.